Job openings drop in October 2023 – Lowest in more than two years

In a recent revelation from the Bureau of Labor Statistics Job Openings and Labor Turnover Survey, the US job market exhibited a subtle shift in October, marking the lowest number of job openings since early 2021. This downturn, as reported by Bloomberg, highlights the Federal Reserve’s intention to gradually cool the labor market, aligning with their broader economic goals.

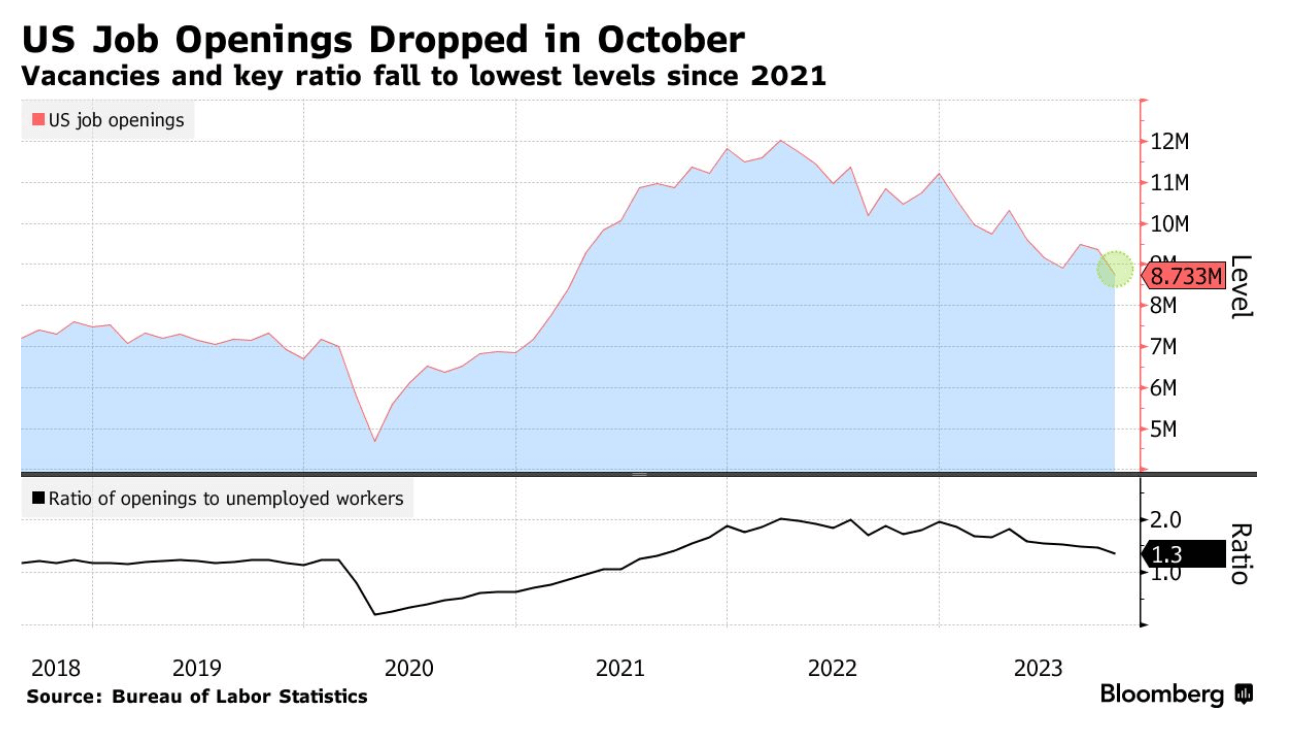

The figures, totaling 8.7 million available positions, reflect a decrease from the revised 9.4 million in the preceding month. This decline, encompassing various sectors, diverged from economists’ expectations, signaling a broader trend in the labor landscape.

As the Federal Reserve maintains elevated interest rates to combat inflation, policymakers are optimistic that the labor market will soften organically, reducing the demand for new workers rather than resorting to job cuts by employers. The strategy has shown promise, with job vacancies retracting from the peak of 12 million last year, contributing to historically low unemployment rates despite recent minor fluctuations.

A parallel report on easing inflation in the service sector, coupled with the JOLTS data, suggests that the Federal Reserve’s dual mandate of employment and price stability is inching towards their long-term estimates, according to insights from Wells Fargo & Co. Economists Tim Quinlan and Shannon Seery Grein note that, although prices are still on the rise, the pace has slowed, and the labor market is exerting less upward pressure on wages.

In a stabilizing trend, the quits rate, measuring voluntary job-leavers as a share of total employment, held steady for a fourth consecutive month at levels reminiscent of early 2021. This contrasts with the peak in the previous year when over four million people were quitting their jobs monthly, reflecting confidence in securing better-paying positions.

The JOLTS data further revealed that layoffs remained historically low, and hiring experienced a slight downturn. Noah Yosif, lead labor economist at workforce-management firm UKG, interprets this as progress towards a soft landing, with a cooldown in job openings and stability in quits and layoffs, indicating a balance between demand and supply in the labor market moderation narrative.

The data aligns with expectations for the Federal Reserve to maintain current interest rates in the upcoming policy meeting, reinforcing the belief that rate cuts are not imminent until inflation is on a sustainable path toward the central bank’s 2% goal, as suggested by Fed Chair Jerome Powell.

The ratio of job openings to unemployed individuals declined to 1.3, the lowest since mid-2021. While indicative of a somewhat tight labor market, the figure has significantly eased over the past year from its 2022 peak of two-to-one.

In analyzing the service sector, as measured by the Institute for Supply Management, employment saw a modest uptick in November amid increased business activity. However, Bloomberg economist Estelle Ou cautions that commentary from service providers suggests only “tepid” improvement, with little indication of sustained expansion in the sector.

Amidst a backdrop of employers scaling back hiring and decelerating wage growth, uncertainties arise regarding the job market’s ability to sustain robust consumer spending. These insights arrive just ahead of the government’s monthly jobs report, forecasting the addition of approximately 189,000 jobs in November, with the unemployment rate expected to remain at its highest level in nearly two years.

It’s worth noting that some economists have raised questions about the reliability of JOLTS statistics, citing the survey’s low response rate. Despite this, the data provides valuable insights into the evolving dynamics of the US job market.